A clinic open to all health insurance companies

Turó Park Clinics is a private medical center located in the Sarriá-Sant Gervasi district of Barcelona. Our clinic has different agreements with a growing number of international insurance companies.

There are 2 options for you to be covered by your insurance:

→ Option 1: Is your insurance part of the clinic's affiliated insurance list? In this case, you don't have to pay anything for your visits.

→ Option 2: Is your insurance not part of the clinic's affiliated insurance list? In this case, you will have to pay for your consultation. However, depending on your insurance policy and reimbursement terms, you may be reimbursed up to 80% or even 100% of the cost of your consultation.

Turó Park Clinics Affiliated Insurances

Turó Park Clinics is part of the medical chart of the following insurances. If you are affiliated with these insurances, it means that your consultations will be covered and paid for.

- Geoblue

- IMG

- Egycross insurance

- Falck

- Air Doctor

Reimbursement insurances

Our clinics usually accept all types of reimbursement medical insurance policies, both Spanish and international. However, it is the patient’s responsibility to contact their insurance provider in advance to confirm whether their policy covers services at our clinic.

In Spain, many health insurance companies offer reimbursement options for medical care. If you have subscribed to one of these options, it is possible to be reimbursed up to 80% or even 100% of the costs of the care received. To do this, you simply need to provide your invoice to your insurance company, which will reimburse you according to the current rates.

Examples of Spanish reimbursement policies are:

- Axa Optima Plus

- Cigna Blue & Gold

- Mapfre Reembolsos de gastos medicos & Salud elite

- Sanitas Blua, +90.00, premium 150.000

- DKV Mundisalud & Top Health

- Adeslas Premier, Plena extra 150, Plena extra 240

- Allianz Salud Reembolso

- Aegon Salud reembolso

- Agrupació Totalmedic

- Asefa Top 75, Top 200

- Asisa Integral 100, Integral 180, Integral 240

- Caser Prestigio

- Fiatc MediFiact Multi

- Generali Salud Total, Salud Elección

- PlusUltra Reembolso

- Previsora Previsalud Oro

- Acunsa Global, First

Specific reimbursement insurances

In Spain, many health insurance companies offer specific options for the reimbursement of medical care. If you have subscribed to one of these options, such as gynecological, psychological, etc., you can be reimbursed up to 80% or even 100% of the costs of the treatment you receive. You can be reimbursed up to 80% or even 100% of the cost of the treatment you receive. All you have to do is submit the bill to your insurance company for reimbursement at the current rates.

The main specific reimbursement insurances available in Spain are:

- Clínicum Premium (medical expenses in gynecology and pediatrics)

- Divina Copago, Completo (medical expenses in gynecology and pediatrics)

- Asefa Top family (Medical expenses in Gynecology, Pediatrics and Alternative Medicine)

- Fiatc MediFiact Select (Medical expenses in Gynecology and Pediatrics)

- Generali Salud Opción Premium (medical expenses in primary care and gynecology)

Understanding the Spanish health system

Basically, healthcare in Spain consists of both private and public healthcare.

If you are living and working in Spain, you will likely have access to free state Spanish healthcare that is essentially free except for small co-payments in some products and services.

If not applicable in your case or if you want to cover yourself for private treatment to access wider and quicker treatment, you'll need to take out private health insurance.

Types of Private Insurance Plans

There are several types of health insurance in Spain. Most of them have a network of doctors and specialists that you can visit free of charge. If you prefer to go to your own doctor, you'll need to get a premium policy.

- Basic Insurance Plan

- You have to choose from a list of doctors approved by your insurer (cuadro medico)

- It covers basic services (visit with doctor, health check, medical analysis)

- Hospitalization costs are usually not covered

This basic insurance can be a good option to avoid long waiting lists in the public system but it's limited.

- Reimbursement Insurance Plan

- You can choose your own doctor, center or hospital without any limitation

- Up to 100% of the cost of the visit reimbursed by the insurance plan

- You must pay the entire cost of the doctor’s visit at the time of service and then submit paperwork in order to be reimbursed (80-100% of the cost of the visit) at a later date (usually after 5-15 days).

- This kind of policy is approximately 20-30€/ month more expensive than basic private insurance plans.

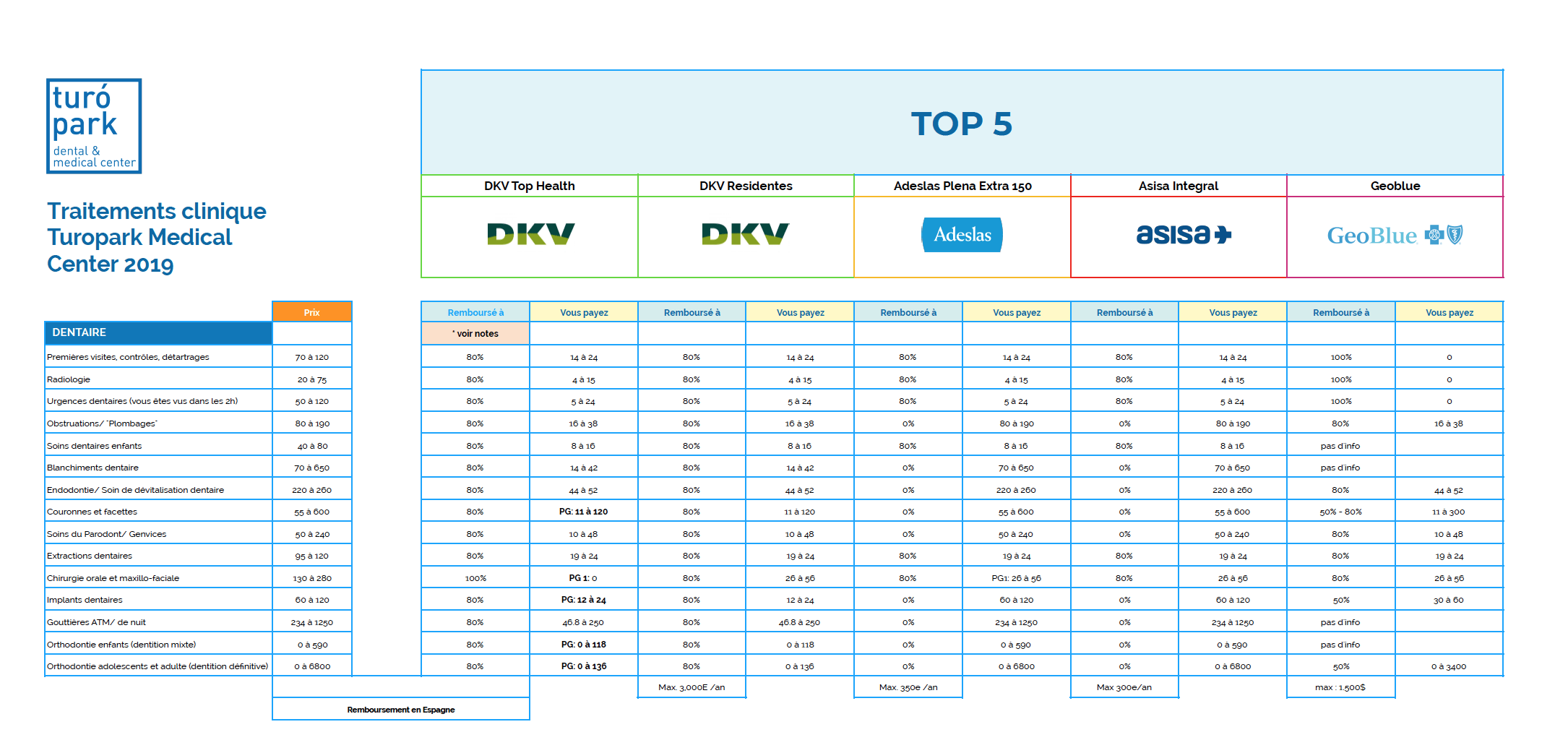

- If you have additional dental insurance added to your reimbursement policy, you can have between 30-100% reimbursed depending on your insurance company and dental procedure.

Here is a summary table presenting the characteristics of these two types of health insurance:

| Type | Basic | Reimbursement |

|---|---|---|

| What is the typical monthly COST? | From 38€ | From 50€ |

| Can I see any doctor I want? | Choose from limited list of doctors | Free to choose any doctor |

| Is everything included in my monthly fee? | No, you pay extras for visits | You pay doctor’s fees and submit your invoice for 80 – 100% reimbursement with your insurer. |

| Examples of insurance companies | DKV, AXA, Adeslas, Sanitas, Mapfre, Cigna | DKV, AXA, Adeslas, Sanitas, Mapfre, Cigna |

| Examples of insurance policies | Adeslas Basica, Adeslas Plena, Adeslas Vital, Sanitas Mas Salud, DKV Integral, DKV Modular, DKV Seleccion, Cigna Salud Plena | Adeslas Plena Extra 150, Sanitas Plena 90.000, DKV Mundi Salud, DKV Residentes, DKV Top Health, Allianz, Cigna Salud Reembolso Blue, Cigna Salud Reembolso Gold (incl USA) |

| What about Turo Park Medical Center’s MEDICAL services? | Medical Analysis, ORL | Medical Analyses, ORL, Pediatrician, General Medical Doctor, Gynecologist, Cardiologist, Infectious Disease, Psychologist |

| Are Turo Park Medical Center’s DENTAL services covered by my insurance if I have dental insurance? | No | If you have EXTRA dental insurance in ADDITION to your general health insurance, some companies may reimburse 30-100% of CERTAIN dental treatments |

| What is the cost of extra dental insurance coverage? | Approx. 9€/ month* But can only go to your insurer’s dental center | - |

How to choose the best health insurance in Spain?

In Spain, there are private health insurance policies adapted to all needs and budgets. However, if you want to see a multilingual doctor or need complementary therapies like acupuncture or homeopathy, you'll need a premium policy.

Turo Park Medical and Dental Center works with the major insurance companies offering private reimbursement policies such as: Axa Optima Plus, Asisa Integral, Allianz Salud Reemboolso, Generali, Fiatc, Cigna Global, DKV Mundisalud, Sanitas Mas, Sanitas Premium, Mapfre Salud Reembolso, Plus Ultra Seguros, RACC Seguros Elección, Bupa Company Gold, Geoblue, Adeslas Pymes Reembolso, Adeslas Extra, Aegon Salud Reembolso, Asefa Salud Top,Agrupació Mutua Universalmedic, and much more.

To help you choose the insurance plan best suited to your needs, we provide you with an analysis of the best providers on the market. You can download it by clicking here.

Do not hesitate to contact us by email or by phone (+34 932 529 729), if you need more information about reimbursment and health insurance plans. Our English-speaking office staff will be happy to answer any of your questions.

You need a doctor?

Meet our doctors or contact us to get a quick appointment!